The Iowa City housing market is experiencing a robust trend of rising home prices. Several factors are contributing to this upward trajectory, including low inventory, high demand, and rising interest rates.

One of the primary factors driving the surge in home prices in Iowa City is the low inventory of homes for sale. This scarcity of available homes is posing challenges for potential buyers and exerting upward pressure on prices.

Another significant driver of escalating home prices is the high demand for homes in Iowa City. The city is a sought-after place to live, particularly for young individuals and families. The presence of the University of Iowa and various other colleges and universities further contributes to this robust demand, helping to maintain elevated home prices.

The Iowa City housing market is expected to continue its strength in the coming months. While home prices are likely to continue rising, the pace of increase may slow down as interest rates continue to rise. Prospective buyers should be prepared to act swiftly and submit competitive offers to secure the homes they desire.

Specific Trends to Watch

Here are some specific trends to monitor in the Iowa City housing market in 2023:

- The number of homes for sale is expected to remain low.

- Homes are expected to continue to sell quickly.

- Buyers are expected to continue making competitive offers.

- Home prices are expected to continue to rise, although the pace of increase may slow down.

Iowa City, IA Housing Market Report

Iowa City, IA is characterized as a buyer’s market, indicating that the supply of homes exceeds the demand. This offers buyers a favorable environment for exploring options and potentially negotiating better deals.

Median Listing and Sold Prices

One of the key indicators of the housing market’s health is the median listing and sold prices. According to realtor.com®, in February 2024, the median listing home price in Iowa City, IA stood at $360K, marking a 5% year-over-year increase. Additionally, the median listing home price per square foot was $186, showcasing the value of properties in the area. Comparatively, the median home sold price was $264K, providing insights into actual transaction prices.

Sale-to-List Price Ratio

The sale-to-list price ratio is an essential metric that indicates how close homes are selling to their asking prices. In Iowa City, IA, the sale-to-list price ratio stands at 97.46%, suggesting that homes are typically selling for approximately 2.54% below asking price. This data is crucial for both buyers and sellers to understand market dynamics and negotiate effectively.

Median Days on Market

The median days on the market is a key metric that reflects the pace at which homes are selling. In Iowa City, IA, homes typically spend 42 days on the market before being sold. This figure provides valuable insights into the level of activity and competition within the housing market. Moreover, it’s noteworthy that the trend for median days on market has been decreasing, signaling a potentially faster turnover of properties.

Looking ahead, the Iowa City, IA housing market is poised for continued growth and stability. Economic factors, such as job growth and interest rates, will likely play a significant role in shaping the market dynamics. Additionally, population trends and housing development projects will influence supply and demand dynamics.

For buyers, the current buyer’s market presents opportunities to explore a wide range of properties and potentially negotiate favorable terms. On the other hand, sellers may need to adjust their pricing strategies and expectations to align with market conditions.

Iowa City Housing Market Forecast for 2024 and 2025

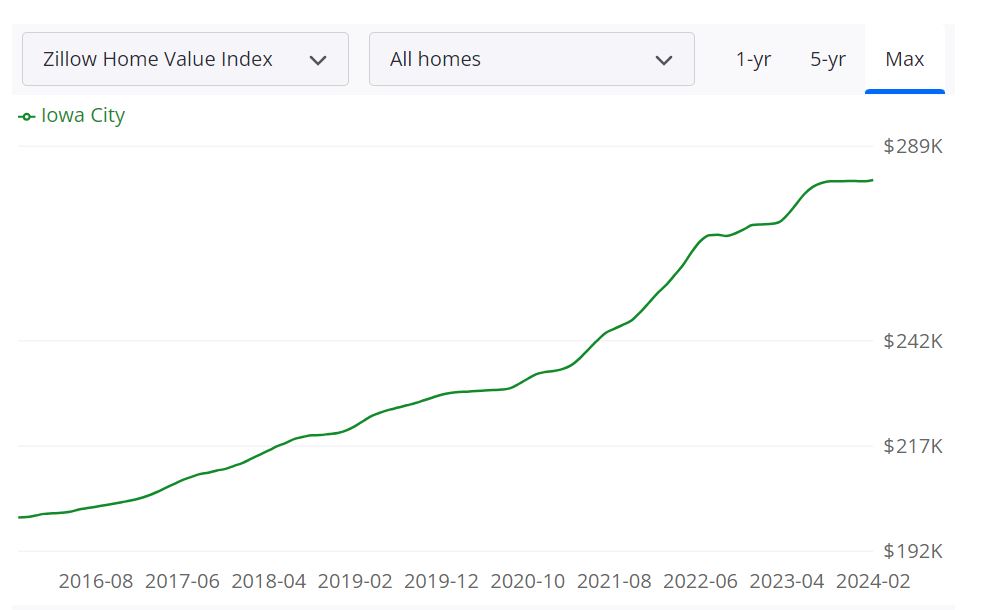

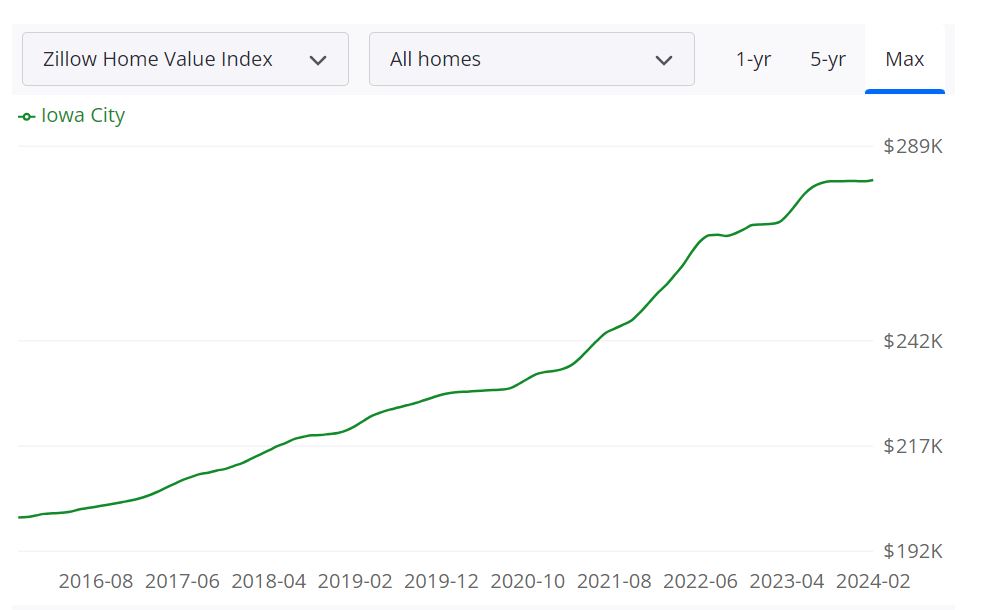

According to Zillow, the average home value in Iowa City stands at $281,140, reflecting a 3.9% increase over the past year. Homes in this market typically go pending in approximately 30 days, indicating a brisk pace of activity.

Understanding Key Metrics

Breaking down these metrics provides a comprehensive view of the Iowa City housing landscape. With 129 homes for sale as of February 29, 2024, and 41 new listings during the same period, there appears to be a healthy inventory available for potential buyers. T

he median sale to list ratio, which stood at 0.984 as of January 31, 2024, suggests a balanced market where homes are selling close to their listed prices. Speaking of prices, the median sale price in January 2024 was $296,417, slightly lower than the median list price of $316,483 recorded on February 29, 2024. This slight variance underscores the negotiation dynamics prevalent in the market.

Furthermore, data from January 31, 2024, indicates that 13.3% of sales were transacted over list price, while 61.8% were sold under list price. These figures illuminate the negotiation power wielded by buyers and sellers, influencing the final transaction prices.

Iowa City MSA Housing Market Forecast

Zooming out to assess the broader housing market forecast for the Iowa City Metropolitan Statistical Area (MSA), projections suggest a moderate growth trajectory. The MSA encompasses Iowa City along with its surrounding counties, constituting a significant portion of the state’s real estate market.

According to the forecast data, as of February 29, 2024, the Iowa City MSA is anticipated to experience a 0.3% increase in housing market performance by March 31, 2024. This modest uptick is projected to gain momentum, with a forecasted growth rate of 0.5% by May 31, 2024. However, looking ahead to February 28, 2025, a slight contraction of -1.5% is predicted, indicating a potential stabilization or adjustment phase.

Are Home Prices Dropping in Iowa City?

While the Iowa City housing market has shown resilience with a 3.9% increase in average home value over the past year, there’s no clear indication of prices dropping in the near future. However, the slight variance between median sale and list prices suggests a potential for price adjustments based on negotiation dynamics and market conditions.

Will the Iowa City Housing Market Crash?

Forecasting a housing market crash requires a thorough analysis of various economic indicators, market trends, and external factors. While the Iowa City housing market forecast indicates fluctuations, such as the projected -1.5% change by February 28, 2025, it’s essential to note that a single metric doesn’t necessarily signify an impending crash. Real estate markets are influenced by a myriad of factors, and continuous monitoring and analysis are crucial to anticipate and mitigate potential risks.

Is Now a Good Time to Buy a House in Iowa City?

Deciding whether it’s the right time to buy a house in Iowa City hinges on individual circumstances, financial readiness, and long-term goals. While the market may offer opportunities for both buyers and sellers, factors such as interest rates, personal finances, and housing needs should be carefully considered. Consulting with a real estate professional and conducting thorough research can help prospective buyers make informed decisions tailored to their specific situation.

Should You Invest in the Iowa City Real Estate Market?

Population Growth and Trends

- Iowa City has experienced steady population growth over the years. Its attraction as a vibrant college town, with the University of Iowa at its heart, has drawn in a diverse mix of residents, including students, faculty, and professionals. This consistent influx of people contributes to a stable demand for housing, making it an enticing prospect for real estate investors.

- Furthermore, Iowa City’s population trends have shown a propensity for long-term growth, bolstered by its reputation as an education hub and a place with a high quality of life. This bodes well for property investors looking for long-term appreciation in their real estate investments.

Economy and Jobs

- Iowa City’s economy benefits from its role as a center for education, healthcare, and technology. The University of Iowa, along with various hospitals and research facilities, provides a steady source of employment opportunities. Additionally, the city’s growing tech sector has been attracting talent and fostering job growth, which is integral to a thriving real estate market.

- The city’s economic diversity and resistance to major economic downturns make it a favorable environment for real estate investors. A robust job market typically translates to a stable pool of renters and potential buyers, adding to the appeal of investing in Iowa City’s real estate.

Livability and Other Factors

- Iowa City consistently ranks as one of the best places to live in the United States. Its livability is driven by factors such as excellent schools, cultural amenities, and a strong sense of community. Real estate investors can capitalize on this by catering to the demand for quality housing options that cater to the city’s diverse population.

- Moreover, Iowa City’s low crime rate and a multitude of parks and recreational opportunities contribute to its desirability as a place to call home. These aspects enhance the city’s potential as an investment location, as they directly impact property values and rental income.

Rental Property Market Size and Its Growth for Investors

- The rental property market in Iowa City is substantial, largely driven by its student population and young professionals. Investors looking to tap into this market can benefit from the consistent demand for rentals, particularly near the University of Iowa campus. Over time, rental rates have shown moderate but steady growth, making it an attractive opportunity for investors seeking cash flow.

- Furthermore, Iowa City’s rental vacancy rates tend to be relatively low, indicating that investors are likely to find tenants quickly. The growth potential for rental income and the opportunity to leverage the presence of a large student population make the city an appealing prospect for real estate investors.

Other Factors Related to Real Estate Investing

- Real estate investors in Iowa City should consider the impact of interest rates on their investments. Rising interest rates can affect both the cost of financing and the affordability of homes for potential buyers, potentially influencing property values.

- Market supply and demand dynamics are crucial to monitor. The city has experienced low inventory, which can drive up home prices. Investors should stay informed about market trends and potential shifts in supply and demand.

- Local regulations and taxes can significantly impact your investment returns. Understanding zoning laws, property taxes, and rental regulations is essential to make informed investment decisions.

- Finally, it’s advisable to work with local real estate professionals who have in-depth knowledge of the Iowa City market. They can provide valuable insights and help you navigate the unique aspects of real estate investing in the area.

References:

- https://www.zillow.com/home-values/5291/iowa-city-ia/

- https://www.realtor.com/realestateandhomes-search/Iowa-City_IA/overview