Thinking of selling your house in Des Moines this year? The market might be tipping the scales in your favor. While the frenetic pace of the pandemic era has calmed, several factors suggest 2024 leans towards a seller’s market. Let’s delve deeper into the Des Moines housing landscape and explore what it means for sellers.

One of the strongest indicators of a seller’s market is inventory. Simply put, how many houses are available for purchase compared to the number of interested buyers? In Des Moines, inventory remains low. This creates a situation where demand outweighs supply, giving sellers leverage in negotiations and potentially fetching higher prices.

Another metric to consider is the time houses stay listed. In a seller’s market, homes typically fly off the shelf. Data suggests Des Moines follows this trend. Homes are selling relatively quickly, spending an average of just 22 days on the market before finding a buyer. This brisk pace signifies strong buyer interest, giving sellers an advantage.

Good news for sellers! Des Moines hasn’t witnessed a dip in home prices. Instead, the median sale price has shown a steady increase over the past year. As of March 2024, the figure stood at $210K, reflecting a 5% year-over-year appreciation (Redfin). This trend suggests a resilient market primed for continued growth.

While the signs are positive for sellers, it’s important to acknowledge the evolving market dynamics. Experts predict 2024 won’t be a complete return to the pre-pandemic era. Gone are the days of houses selling above asking price within days of listing. Buyers are becoming more cautious, especially with rising mortgage rates.

Des Moines, IA Housing Market Forecast for 2024 & 2025

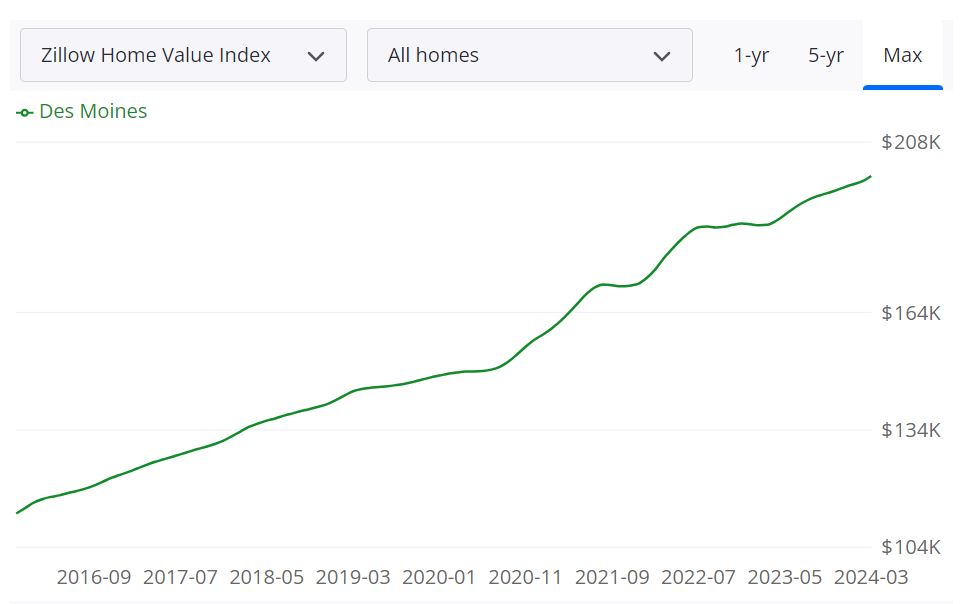

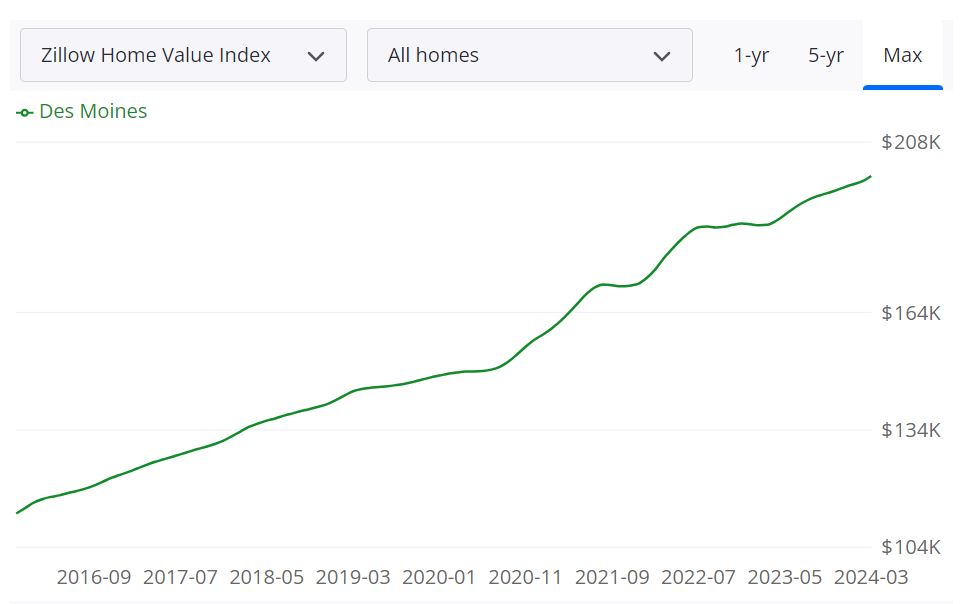

The average home value in Des Moines stands at $199,739, marking a 6.7% increase over the past year (Zillow). Homes in the area typically go pending in approximately 15 days, underscoring the rapid pace of transactions in the market. As of February 29, 2024, the median sale price stood at $196,250, while the median list price was $221,633 as of March 31, 2024.

The market dynamics indicated a 20.7% of sales going over the list price, contrasted by 57.8% going under the list price during the same period. Looking ahead, based on the forecast data available until March 31, 2024, the Des Moines MSA anticipates a 0.4% growth by April 30, 2024, followed by a 0.7% increase by June 30, 2024, and a slight dip of -0.1% by March 31, 2025.

This graph illustrates the growth of home values in the region over the past year, along with a forecast suggesting this trend will likely continue for the next year.

Here’s a breakdown of the Des Moines housing market forecast for 2024 and 2025:

Overall Trend: Experts predict a continuation of the transitional market from 2023, with 2024 offering more stability than a full return to normalcy.

Key Factors:

- Inventory: Inventory is expected to remain low, favoring sellers but potentially limiting the overall number of transactions.

- Prices: The forecast suggests a moderate increase in home prices, though not at the dramatic pace seen earlier in the pandemic.

- Mortgage Rates: Interest rates are a wild card. If they dip in the first half of 2024, it could fuel buyer demand and potentially push prices higher. However, stable or rising rates might cool some buyers down.

- Sales Pace: The speed of sales is likely to stay moderate, with homes no longer disappearing within days but still finding buyers in a reasonable timeframe.

Apartment Market: The forecast for apartments is brighter, with all submarkets projected to experience significant rent growth exceeding 4% by the end of 2024.

2025 Outlook: While there are no concrete predictions for 2025, the overall trend of a stable market with moderate price growth is likely to continue, barring any unforeseen economic shifts.

Should You Invest in the Des Moines Real Estate Market?

Population Growth and Trends

Investors contemplating the Des Moines real estate market should carefully examine various factors, starting with population growth and trends.

- Steady Population Growth: Des Moines has been experiencing consistent population growth, with approximately 663,381 residents in 2022. This upward trend is a positive sign for real estate investors as it indicates a growing demand for housing.

- Diverse Demographics: The city attracts a diverse range of residents, contributing to a dynamic real estate market. A mix of demographics can create opportunities in various property types, from family homes to apartments.

Economy and Jobs

The local economy and job market play a vital role in determining the attractiveness of a real estate market for investors.

- Strong Economy: Des Moines boasts a robust and diversified economy, with sectors such as insurance, finance, healthcare, and technology contributing to its economic stability. This diversity can provide stability to the real estate market, even during economic fluctuations.

- Job Opportunities: A healthy job market is crucial for attracting residents and tenants. Des Moines has low unemployment rates and continues to create jobs, making it an appealing destination for those seeking employment.

Livability and Other Factors

The overall livability of a city and additional factors can significantly impact the real estate market’s appeal to investors.

- Livability: Des Moines is known for its high quality of life, with affordable housing, excellent schools, and a vibrant cultural scene. A city’s livability can drive demand for real estate, making it an attractive investment location.

- Tax Benefits: Iowa offers various tax incentives for homeowners and investors, which can positively impact your financial returns from real estate investments.

Rental Property Market Size and Growth

Investors interested in rental properties should assess the size and growth of the rental market.

- Rental Demand: Des Moines has a consistent demand for rental properties, with a mix of students, young professionals, and families seeking rental units. Understanding the specific rental demographics can help you target your investment strategy.

- Rental Income Potential: The city’s rental market can provide attractive income opportunities, especially in neighborhoods with strong rental demand.

Other Factors Related to Real Estate Investing

Investing in real estate involves various considerations beyond the local market. These include:

- Market Research: Conduct thorough research on property prices, historical trends, and market conditions in Des Moines. This data will help you make informed investment decisions.

- Property Management: Decide whether you will manage properties yourself or hire a property management company. Property management can impact your investment’s success and your peace of mind.

- Risk Mitigation: Diversify your real estate investments to spread risk. Consider various property types, such as residential, commercial, or multifamily, to balance your portfolio.

References:

- https://www.zillow.com/DesMoines-ia/home-values

- https://www.redfin.com/city/4570/WA/Des-Moines/housing-market